Learn Accounting Professionally

Tally Authorized Center AT JBK ACADEMY

Become a certified Tally professional with hands-on accounting, GST, and payroll training. Join Hyderabad’s most trusted institute today!

- ⭐⭐⭐⭐⭐ 4.8 Ratings

- 500+ Placement Partners

Course Highlights

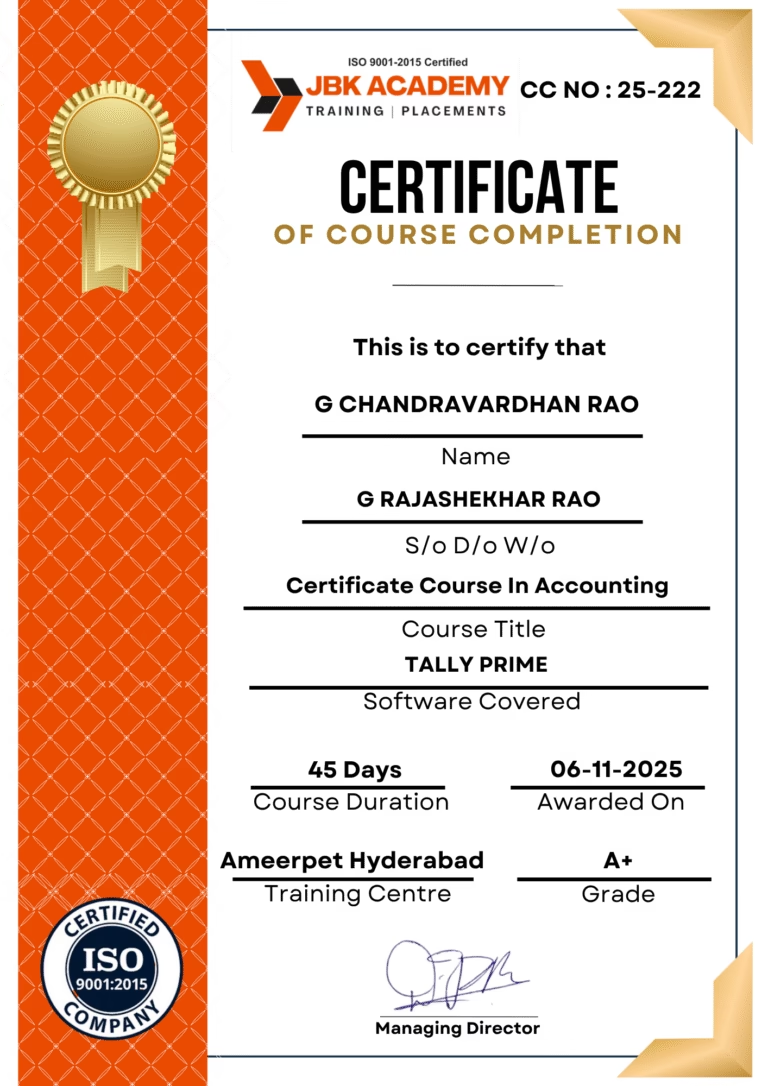

Gallery

Snapshots from Learning, Growth & Certification

Tally Authorized Center Curriculum Overview

Module 1: Introduction to Tally Prime

- What is Accounting

- Objectives of Accounting

- Types of Accounts

- Fundamental Accounting Equation

- Double Entry System

- Common Financial Statements

Module 2: Introduction to Tally Prime

- Overview of Tally Prime

- Navigating the Tally Prime Interface

- Understanding Key Functionalities and Features

Module 3: Advanced Accounting Features

- Advanced Accounting Setup: Configuring Ledgers, Groups, and Cost Centers

- Advanced Inventory setup: Stock Groups, Categories, and Items: Advanced Setup and Configurations

- Managing Foreign Exchange Transactions: Currency Management and Forex Rates

- Vouchers in Detail: Recording complex transactions using Payment, Receipt, Journal, Contra, and more

Module 4: Inventory and Stock Management

- Bill of Materials (BoM): Creation and Management of Complex Bills of Materials

- Multiple Stock Locations: Managing Multiple Godowns/Stores in Tally Prime

- Stock Transfers and Adjustments: Handling Stock In Transit, Stock Adjustments, and Stock Valuation Reports

- Inventory Valuation: FIFO, LIFO, and Average Cost Method

Module 5: Financial Management

- Financial Statements: Profit & Loss, Balance Sheet, and Cash Flow

- Ratio Analysis: Calculating and Interpreting Financial Ratios

- Budgets and Controls: Creating and Monitoring Budgets

- Audit and Reconciliation:

- Bank Reconciliation

- Cash Flow and Bank Audit

- Reconciliation of GST Returns

Module 6: Payroll and Employee Management

- Employee Setup and Payroll Configurations

- Salary Structures: Designing Complex Salary Structures and Pay Components

- Statutory Compliances: PF, ESI, and Professional Tax Management

- Generate Payroll Reports: Salary Slips, Pay Register, and Form 16

- Leave Management: Tracking and Managing Employee Leave

Module 7: GST and Taxation (Advanced)

- Taxation Handling:

- GST Computation and Returns

- Tally GST Reports (GSTR-1, GSTR-3B, GSTR-9)

- TDS and TCS Management

- GST and TDS Reconciliation

- Advanced GST Configuration: Tax Categories, HSN/SAC Codes, and Reverse Charge Mechanism

- GST Auditing and Filing: Generating GST Audit Reports

- GST on E-Commerce Transactions: Handling GST for E-Commerce Sellers and Buyers

- TDS & TCS Advanced Configurations: Handling Different TDS/TCS Rates, Reporting, and Filing

- Customizing Tax Reports and Returns

Module 8: Advanced Reporting and Analytics

- Customizing Reports: Creating and Modifying Reports (Financial, Inventory, etc.)

- Tally Prime Dashboard: Setting up and Analyzing Custom Dashboards

- Data Exporting and Importing: Exporting Reports to Excel, PDF, and XML formats

- Multi-Company Reporting: Consolidating Financial Data Across Multiple Companies

- Advanced Financial Reports: Cash Flow, Receivables/Payables, and Trial Balance

Module 9: Data Management and Security

- Data Backup and Restoration: Techniques for Backup, Restoring, and Data Integrity

- Managing Multiple Users and Roles: Configuring User Permissions and Rights

- Import and Export Data: Bulk Importing/Exporting Data using Tally

Module 10: Tally Prime Customization

- Creating Custom Invoices and Vouchers: Designing Templates for Vouchers and Invoices

Module 11: Advanced Business Solutions in Tally Prime

- Cost Centers and Cost Categories: Advanced Management for Cost Control

- Consolidation of Multiple Companies: Inter-Company Transactions and Consolidated Reports

- Handling Complex Transactions: Advanced Transactions and Entry Configuration

Expert Certification In Accounting

The Expert Certification in Accounting – Package 1 (5 Months) is a complete, job-oriented professional accounting program designed to transform beginners into confident accounting professionals.

Master Diploma In Accounting

The Master Diploma in Accounting – Package 1 is a 4-month training program designed to provide practical knowledge of office tools, computerized accounting, and cloud-based accounting systems.

Advanced Diploma In Accounting

The Advanced Diploma in Accounting is a 7-month professional program designed to provide structured training in modern accounting practices used in offices, firms, and corporate environments.

Get Certified by JBK Academy – Your skills, recognized worldwide!

Limited Seats – Enroll Now

Our Hiring Partners

Trusted by Companies Looking for Skilled Tally Professionals

Checkout Our Testimonial

After completion of my degree I have joined JBK Academy to learn tally software, Advanced Excel and Sap fico course training. I felt very happy this institute. Thank you madam

I had a great learning experience with the tally course at jbk academy. The trainers explained every concept in a simple and practical way making it easy to understand GST, Payroll, and accounting processes.

It's a very good place to learn tally prime, Advance Excel, SAP etc. Excellent teaching and life time technical support will be provided to students

Over all good experience and I learnt advance Excel and tally prime .jbk academy is the good platform to learn new skills.

Best training institute for tally course and sap fico course training, lab facilities are too good with best faculties

Get in touch

- 9985023100

- 7-1-451/22/10 First floor, Durga Bhavani Complex, Kumar Basti, Ameerpet, Hyderabad, Telangana 500016