ITR & GST Tax Practitioner

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

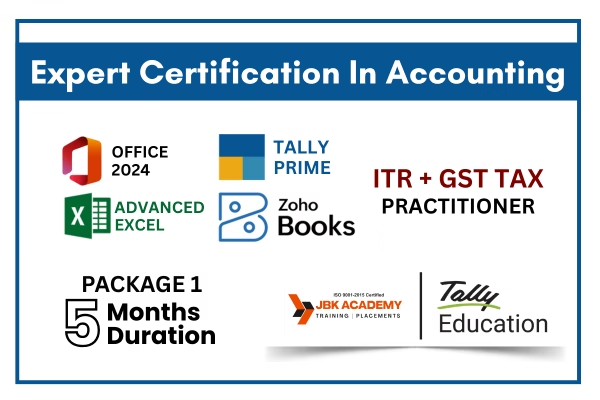

The Expert Certification in Accounting – Package 1 (5 Months) is a complete, job-oriented professional accounting program designed to transform beginners into confident accounting professionals. This course is carefully structured to meet the current needs of the finance and accounting industry, combining core accounting knowledge, taxation, cloud accounting, and advanced reporting skills in one powerful certification program. This program covers the most in-demand tools used by companies today, including MS Office 2024, Advanced Excel, Tally Prime with GST, Zoho Books, and ITR & GST Tax Practice. From basic office operations to real-time corporate accounting and taxation, students gain hands-on experience at every stage of the course. The training focuses on 100% practical learning with live examples, real business scenarios, and industry-standard workflows. Students work on actual financial data, prepare balance sheets, file GST returns, generate MIS reports, and perform online accounting just like in real companies. This practical exposure builds strong confidence and makes students job-ready from the first day of employment.Our curriculum is designed not only for students from commerce backgrounds but also for graduates from any stream who wish to enter the accounting field. Even beginners with no prior accounting knowledge can comfortably learn, as the course starts from the fundamentals and gradually moves to advanced professional-level concepts.

Income Tax Basics

PAN & Compliance

ITR Filing (Individual & Business)

GST Registration

GSTR Filing

Input Tax Credit (ITC)

Live Practical Tax Filing

Real Client Case Studies

This course is suitable for:

JBK Academy is a leading institute for Accounting Training in Ameerpet Hyderabad, join the course and connect with the industry.

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

Loading… ISO Certification We Are Providing ISO Certification For Our Students. 15000+ Students We bring the right people together to challenge established thinking Accredited &

Home All Courses Gallery Course Overview The Diploma Program in Accounting – 3 Months is a short-term professional accounting course designed to provide practical knowledge

No, beginners from any background can join.

Yes, it is designed for direct job placement.

Yes, full placement assistance is provided.

5 months.

Yes, you will receive course completion certificates.