ITR & GST Tax Practitioner

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

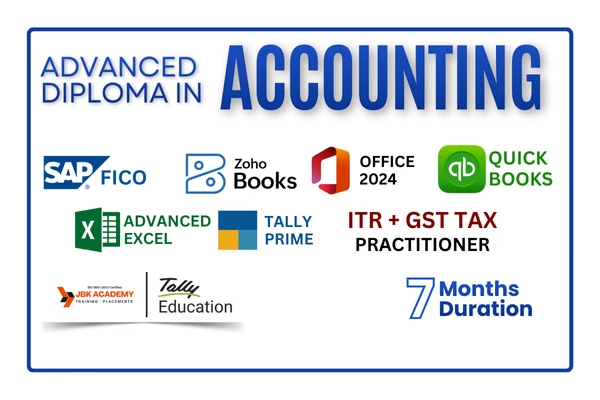

The Advanced Diploma in Accounting is a 7-month professional program designed to provide structured training in modern accounting practices used in offices, firms, and corporate environments. The course includes office automation, advanced spreadsheet usage, computerized accounting, cloud-based accounting platforms, ERP finance systems, and practical income tax and GST filing procedures. The curriculum focuses on transaction processing, financial reporting, statutory compliance, and business accounting workflows followed in real organizations. Learners are trained on multiple accounting platforms to gain exposure to both traditional and digital accounting systems.

Income Tax Basics

PAN & Compliance

ITR Filing (Individual & Business)

GST Registration

GSTR Filing

Input Tax Credit (ITC)

Live Practical Tax Filing

Real Client Case Studies

This course is suitable for:

JBK Academy is a leading institute for Accounting Training in Ameerpet Hyderabad, join the course and connect with the industry.

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

Loading… ISO Certification We Are Providing ISO Certification For Our Students. 15000+ Students We bring the right people together to challenge established thinking Accredited &

Home All Courses Gallery Course Overview The Diploma Program in Accounting – 3 Months is a short-term professional accounting course designed to provide practical knowledge

No, beginners from any background can join.

Yes, it is designed for direct job placement.

Yes, full placement assistance is provided.

7 months.

Yes, you will receive course completion certificates.