ITR & GST Tax Practitioner

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

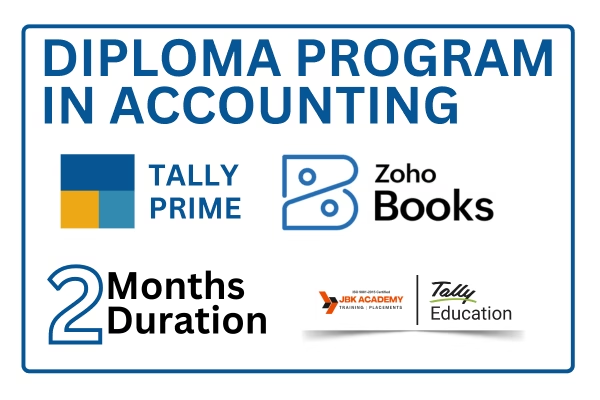

The Diploma Program in Accounting is a 2-month practical training program designed to provide working knowledge of basic accounting operations using Tally Prime and Zoho Books. The course concentrates on day-to-day accounting activities followed in small businesses, trading firms, and service organizations. This program covers company setup, transaction entry, billing, banking activities, and basic financial report preparation. The training is structured for quick skill development for entry-level accounting roles and basic business accounting management.

This course is suitable for:

JBK Academy is a leading institute for Accounting Training in Ameerpet Hyderabad, join the course and connect with the industry.

Home All Courses ITR & GST tax Practitioner About ITR & GST Tax Practitioner Course It is a comprehensive course. The ITR & GST tax

Loading… ISO Certification We Are Providing ISO Certification For Our Students. 15000+ Students We bring the right people together to challenge established thinking Accredited &

Home All Courses Gallery Course Overview The Diploma Program in Accounting – 3 Months is a short-term professional accounting course designed to provide practical knowledge

No, beginners from any background can join.

Yes, it is designed for direct job placement.

Yes, full placement assistance is provided.

2 months.

Yes, you will receive course completion certificates.